Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

This audio version covers: Why Your CRM is Your New Compliance Officer: Automating NCCP Notes with Generative AI

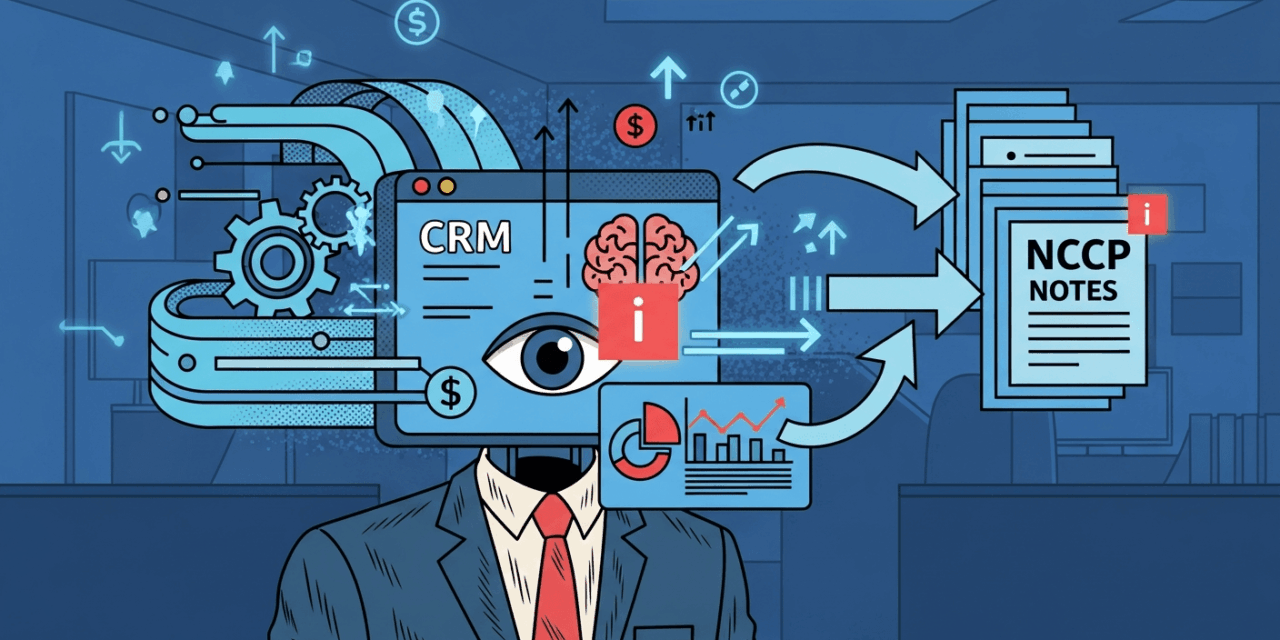

Why Your CRM is Your New Compliance Officer: Automating NCCP Notes with Generative AI

The administrative burden of compliance is one of the biggest pain points for the modern mortgage broker. Crafting detailed, compliant NCCP notes for every client interaction is time-consuming but non-negotiable. It’s the bedrock of your audit trail and your first line of defence in a dispute.

Enter the siren song of Generative AI.

New platforms are promising to slash this administrative load, with some claiming the ability to draft extensive compliance notes—up to 2,500 words—instantly. However, the OAIC has fired a major warning shot regarding data privacy. How do you balance efficiency with security?

Table of Contents

Step 1: Calculating the Real ROI of Automation

The temptation is to measure the value of AI in hours saved from typing. The real return on investment (ROI), however, is far greater.

The 3 Pillars of AI ROI

- Consistency & Quality: AI-driven systems can generate perfectly structured, consistent, and detailed file notes every single time. This rigorous audit trail is your best asset in mitigating complex complaints.

- Proactive Compliance: Instead of just recording what happened, integrated AI can actively guide the compliance process.

- Quantifiable Efficiency: Platforms like CreditPolicy.com.au allow you to track deal flow and time-to-submission, giving you a tangible measure of resources saved.

Step 2: The Compliance Firewall

The Office of the Australian Information Commissioner (OAIC) has warned against entering personal client information into public AI tools. Doing so can be a significant breach of your privacy obligations.

⚠️ The Critical Distinction

The only secure path forward is what we call the “Compliance Firewall”: using only integrated, closed-loop AI systems where your client’s data never leaves your secure environment.

New broker-specific technologies are designed with Australian compliance in mind:

- The All-in-One Platform: Solutions like CreditPolicy.com.au build their AI Policy Engine directly into the core CRM. Data isn’t sent to a public tool; it’s processed within a governed ecosystem.

- The Specialist AI Assistant: Tools like BrokerBuddie.ai provide assistants trained specifically on lender policies (e.g., ResBuddie), ensuring queries don’t feed public models.

Step 3: AI Risk Mitigation Checklist

Adopting this technology doesn’t mean abdicating your responsibility. You must retain the “human-in-the-loop” to review, edit, and verify outputs to avoid “hallucinations.” Use the checklist below to audit your strategy.

| Risk Area | OAIC/ASIC Concern | Mitigation Strategy (Actionable Step) |

|---|---|---|

| Client Data Leakage | Personal/Sensitive data entered into public GenAI tools. | Only use integrated, closed-loop AI systems (e.g., CRM-based); ensure no identifiable info is uploaded to external platforms. |

| Misleading Advice | Outputs are inaccurate but appear credible (“Hallucinations”). | Human broker must retain full control to review, edit, and attach all generated notes. |

| Operational Resilience | Security failures (APRA CPS 230/234). | Verify the technology provider’s information security controls and breach notification protocols. |

| Evidence of BID | Compliance is judged on outcomes. | Ensure AI generates structured, consistent file notes grounded in factual client data. |

The Takeaway: Your CRM is Now Your Co-Pilot

Stop thinking of your CRM as a filing cabinet. The future of broking is a single, secure platform that acts as your co-pilot—instantly finding policy, automating workflows, and drafting audit-ready notes.

Ready to secure your compliance workflow?