Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

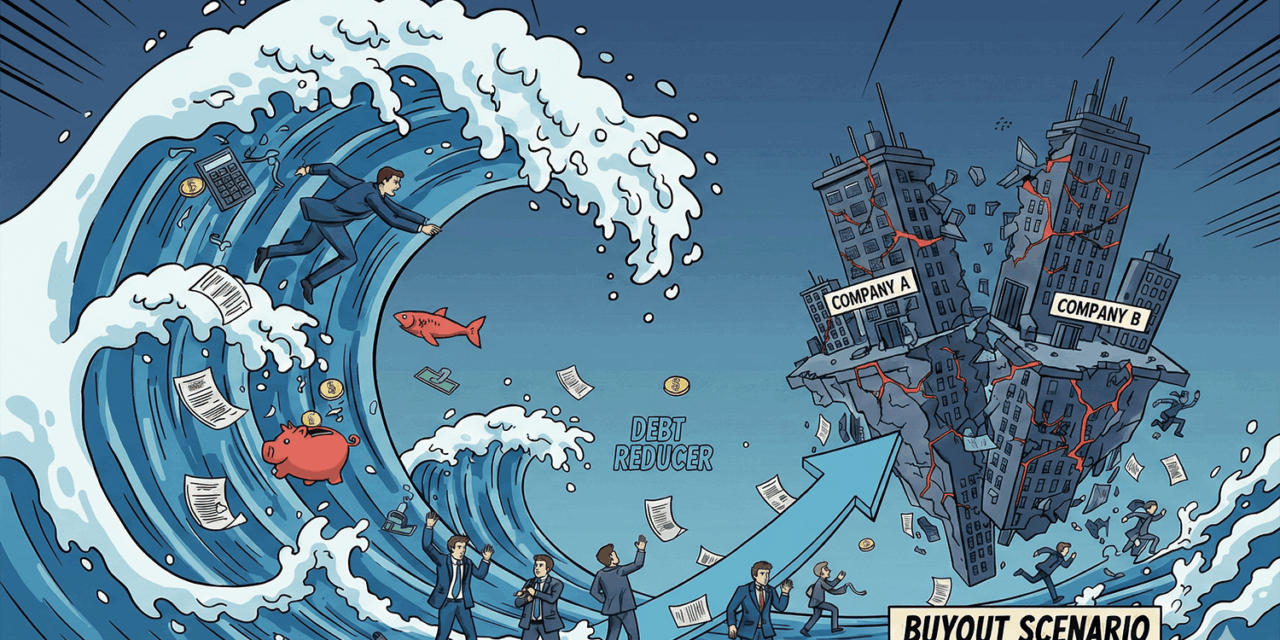

This audio version covers: The Separation Tsunami Utilizing Common Debt Reducer and Actual Repayment Policies in Buyout Scenarios

The Separation Tsunami: Utilizing “Common Debt Reducer” and Actual Repayment Policies in Buyout Scenarios

As the “Separation Tsunami” hits Australian households in 2026, brokers have become the financial first responders for separating spouses. Mastering specific non-bank policies—such as the Common Debt Reducer (CDR)—is now essential for facilitating property buyouts when serviceability is tight.

Article Contents

Step 1: The 2026 Property Landscape

The Australian property market in 2026 is defined by a demand shock driven by a persistent housing shortage and government policy interventions.[1, 2] This environment makes equity buyouts a critical tool for separating couples who wish to retain their homes amid tight rental markets.[3, 4]

| Capital City | Projected Growth (%) | Primary Driver |

|---|---|---|

| Perth | 12.8% | Severe supply shortage [1] |

| Brisbane | 10.9% | Infrastructure & Migration [1, 2] |

| Darwin | 10.5% | Affordability relative to East [1] |

| Sydney | 5.8% | High entry costs [5] |

Brokers must treat valuations as moving targets; a property may increase in value by 5% or more between separation and settlement.[6, 7]

Step 2: Regulatory Guards (BID & RG 181)

ASIC’s update to Regulatory Guide 181 (RG 181) in December 2025 shifted the industry toward an “objective standard” for managing conflicts.[8, 9]

Critical Compliance Note

If a conflict of interest cannot be managed without a risk of material harm to the consumer, the guidance suggests it must be avoided. Disclosure alone is often insufficient for high-conflict separations.[9, 10]

Step 3: Actual Repayments vs. Buffers

Under standard APRA-regulated lending, banks apply a 3% serviceability buffer.[11, 12] In an environment with rates near 6.5%, clients are assessed at 9.5%—the “Mortgage Prisoner” trap.[13, 14]

The Non-Bank Alternative

Specialist lenders like Pepper Money and Liberty Financial may utilize “actual repayments” for external debts rather than sensitized figures.[15, 16] They also offer flexibility for:

- Child Support: Accepting 100% of CSA-registered income.[17, 18]

- Life Events: Exceptions for divorce-related arrears.[19, 20]

- Extended Terms: Up to 40-year loan terms to lower monthly stress.[21]

Step 4: The Common Debt Reducer Solution

The “Common Debt Reducer” (CDR) is a policy that addresses the 100% liability rule. Traditionally, lenders count 100% of a joint debt against a single applicant.[22] CDR allows for apportionment:

Requirements for CDR

- 6 months of clean shared debt statements.[22]

- Evidence the other party is self-supporting (payslips/NOA).[22]

- Clear credit file for both parties on the joint debt.[22]

Step 5: Valuation Strategy

An upfront valuation is the “fulcrum” of a separation buyout. Brokers should facilitate this before legal orders are finalized to avoid the “Appraisal Trap”.[23, 21]

| Valuation Type | Reliability | Use Case |

|---|---|---|

| Market Appraisal | Low | Real estate agent marketing [23] |

| Desktop Valuation | Medium | Standard low-LVR properties [24] |

| Sworn Valuation | High | Family Law settlements [25, 26] |

The Broker Protocol: Action Items

To future-proof your business in 2026, adopt this workflow for separation cases:

✅ Safety First: Ensure separate communication and secure joint accounts (redraw).[27, 28]

✅ CDR Analysis: Stress-test scenarios at major banks vs. specialist CDR lenders.[22, 13]

✅ Upfront Valling: Order valuations early to confirm the “safe price”.[23, 29]

✅ Narrative Underwriting: Tell the “story” behind credit blips to specialist underwriters.[30, 19]

Download the Buyout Policy Checklist