Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

This audio version covers: The Commercial Finance Skill Gap: Your Step-by-Step Guide to CAFBA Accreditation and Loan Structuring Mastery

The Commercial Finance Skill Gap: Your Step-by-Step Guide to CAFBA Accreditation and Loan Structuring Mastery

The successful transition into commercial finance requires specialized knowledge that goes beyond residential lending mandates. Mortgage brokers looking to enter the commercial space must commit to structured professional development to build credibility and manage the heightened complexity of business finance [User Query].

I. The Commercial Imperative: Strategic Justification for Transition

The Australian financial landscape is undergoing a profound structural shift, fueled by infrastructure investment, housing demand, and dynamic capital markets.[1] For mortgage brokers accustomed to the standardized compliance and credit assessment frameworks of residential lending, the transition to commercial finance represents a critical professional evolution, demanding immediate commitment to specialized knowledge acquisition. This shift is necessitated by the fundamental difference between the two domains: residential lending is consumer-focused, assessing capacity to repay household debt under the National Consumer Credit Protection Act (NCCP); commercial lending is enterprise-focused, scrutinizing business viability, operational cash flow, and asset realization strategies [User Query].

A. Defining the Commercial Finance Skill Gap

The primary challenge facing residential brokers entering the commercial space is the inherent complexity of business risk assessment. Traditional residential training rarely prepares a professional to navigate nuanced loan structuring, the evaluation of business creditworthiness via complete financial statements, or mastery of regulatory compliance specific to property development and asset finance.[2] This knowledge vacuum, referred to as the Commercial Finance Skill Gap, places prospective brokers at significant risk of reputational damage and poor client outcomes [User Query]. Success requires structured professional development that focuses specifically on commercial methodologies, such as those provided through the Commercial & Asset Finance Brokers Association (CAFBA) PACE Premium program.[2]

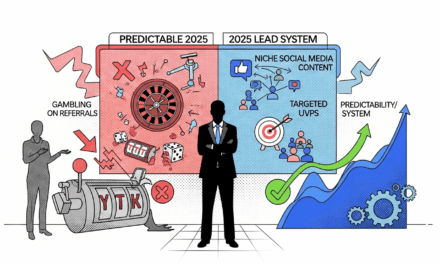

B. Current Dynamics of the Australian Commercial Lending Market (2024/2025 Outlook)

Current market indicators confirm that the investment required to bridge the skill gap is justified by rapid growth and robust opportunity. Australia is experiencing a commercial boom driven by post-COVID recovery, government stimulus measures, and high employment levels, which contribute to steady interest rate environments.[1]

The scale of expansion is evident in recent statistics. In the six months leading up to September 2024, a record 7,023 brokers were actively writing commercial loans, marking a substantial 24% year-on-year (YoY) increase from the corresponding period in 2023.[1] Furthermore, settled loan values reached a staggering $22.69 billion, demonstrating 31% YoY growth.[1] This surge underscores a liquid market with high capital demand from businesses seeking expansion and refinancing.[1]

A crucial element shaping this market is the ongoing ascendancy of non-bank lenders and private capital. While traditional banks face regulatory constraints concerning credit and capital, non-bank lenders have successfully expanded their market share by offering greater flexibility, speed, and tailored solutions, particularly for alternative documentation loans.[1, 3] This shift means that a proficient commercial broker must master a broad spectrum of funding sources, extending beyond the traditional major bank accreditation, to meet client demands for flexibility and simplicity.[1]

C. Lender Sentiment and Asset Class Stratification

Lenders are demonstrating a strong, albeit selective, appetite for financing Australian real estate, confirming the durability of the market boom. According to recent surveys, 56% of lenders intended to increase their commercial real estate exposure in the first half of 2025.[4] Crucially, no surveyed lenders planned to decrease their books, indicating sustained competitive tension and a strong capital supply, supported by domestic banks’ robust balance sheets and significant capital raised in the private credit sector.[4]

However, this appetite is highly stratified by asset class. Lenders are actively pursuing a “flight to quality,” favoring strong assets and sponsors.[4]

Table 1 details the current investment preferences of commercial lenders:

| Rank | Preferred Asset Class | Significance for Strategic Targeting |

|---|---|---|

| 1 | Industrial and Logistics | Highest preference, aligned with smooth supply chains and infrastructure growth. |

| 2 | Residential (Build-to-Sell) | Directly capitalizes on chronic undersupply and housing demand. |

| 3 | Residential (Build-to-Rent) | Strong medium-term investment based on reliable tenancy models. |

| 4 | Retail | Mid-tier; recovery showing green shoots. |

| 5 | Office – Repositioning | Cautious approach, requiring specialized expertise in asset enhancement. |

| 7 | Office – Stabilised | Lowest preference among major asset classes. |

The consistent ranking of Industrial and Logistics as the most attractive investment [4] demonstrates a clear alignment between macroeconomic drivers (infrastructure, trade recovery) and capital flow.[1] This pattern dictates that a transitioning broker should strategically prioritize clients operating within these favored sectors—such as logistics, e-commerce support, or specialized regional development—to enhance the probability of successful financing. Conversely, while the overall sentiment towards the Office sector remains cautious, lenders are willing to price aggressively for Prime and A-grade assets in core locations.[4] This suggests that expertise in financing *repositioning* projects, which inherently involve greater complexity and risk assessment, will be essential for brokers looking to secure deals in this segmented asset class. Property type and location remain the top factors influencing lender willingness to refinance, underscoring the mandatory shift toward asset-level due diligence.[4]

II. Formalising Expertise: The CAFBA Accreditation Roadmap

The success of a residential broker’s transition hinges on establishing immediate credibility within the commercial ecosystem. Formal accreditation and targeted professional development, specifically through the Commercial & Asset Finance Brokers Association (CAFBA), serve as the mandatory bridge across the skill gap. CAFBA is recognized as the peak national body for equipment finance brokers, providing essential professional development, training, and industry accreditation.[2, 5]

A. The Role of CAFBA in Establishing Credibility and Competence

For new entrants, CAFBA membership is not merely a formality; it is a strategic tool for mitigating the lack of a commercial track record. Many lenders, such as ANZ, note that approval for commercial accreditation may be subject to further assessment of experience and background.[6] Some lenders formally stipulate that brokers with less than two years of commercial experience may not be accredited. However, these institutions often make an exception if the applicant holds current CAFBA membership.[6] By investing in CAFBA membership, the transitioning broker proactively demonstrates a commitment to recognized commercial standards, which can accelerate the process of securing essential lender panel accreditation.

B. Step-by-Step Guide to CAFBA Membership

CAFBA Accreditation Pathway

The CAFBA membership process is specifically structured to facilitate the entry of experienced residential brokers. Current financial members of the Mortgage and Finance Association of Australia (MFAA) benefit from a reciprocal arrangement, which grants a 50% discount on the annual CAFBA membership fee.[6]

- Leverage your MFAA membership: Upload a copy of your current MFAA membership certificate during the online application and notify the CAFBA Secretariat.[6]

- Committee Approval: All applications, irrespective of prior experience, are subject to approval by the CAFBA Committee.[6]

- Meet Lender-Specific Requirements: During the subsequent lender accreditation phase, specific requirements must be met. For example, ANZ requires a police check less than 90 days old and a unique email address registered specifically for commercial brokering purposes.[6]

C. Deep Dive: The CAFBA PACE Premium Education Program Curriculum

The PACE Premium education program is designed as the core knowledge repository, providing commercial loan brokers with the specialized skills necessary to succeed.[2] Completion of this program builds crucial trust with both clients and lenders.[2]

The curriculum mandates mastery of concepts distinct from residential lending:

- Loan Structuring: Detailed education on balancing the use of secured and unsecured options, managing fixed versus variable interest rates for corporate debt, and tailoring complex repayment schedules to business cash flow cycles.[2]

- Risk Assessment: Focuses on interpreting and analyzing full financial statements—including Balance Sheets, Profit and Loss accounts, and crucially, Cash Flow Statements—alongside evaluating industry-specific volatility.[2]

- Regulatory Compliance: Training covers specific Australian financial regulations and responsible lending obligations that pertain uniquely to commercial and property development finance.[2]

- Specialized Finance Products: Includes essential topics covering complex areas such as development finance and asset-based lending (ABL).[2]

The commitment to this structured training serves as proactive risk mitigation. Commercial lending involves inherently higher risks for the broker—including the potential for reputational damage and poor client outcomes—if structures are inadequate [User Query].

III. The Conceptual Foundation: Risk, Regulation, and Responsibility

The transition into commercial finance requires a fundamental reorientation concerning regulatory compliance. The legal and professional environment governing commercial transactions differs starkly from the consumer protection regime that defines residential lending. Mastery of the commercial sector demands the replacement of familiar consumer-focused duties with high-stakes, statute-specific obligations related to securing business assets.

A. The Regulatory Paradigm Shift: NCCP and the Commercial Exemption

In Australia, the National Consumer Credit Protection Act 2009 (NCCP) provides the legislative backbone for responsible lending, central to which is the Best Interests Duty (BID) for home lending.[7, 8] However, commercial loans—defined as credit used primarily for business purposes rather than personal consumption—typically fall outside the scope of the NCCP and the statutory BID obligation.[8, 9] While this exemption exists, brokers cannot purport to contract out of the anti-avoidance provision in Section 158T of the NCCP, and ASIC provides guidance that brokers cannot avoid the obligation through notice or disclosure if the underlying credit is indeed consumer credit.[10]

The removal of the statutory BID safety net fundamentally alters the broker’s professional responsibility. When acting in a commercial capacity, the broker’s duty transforms into a fiduciary-like obligation rooted in common law and professional standards. Without prescriptive conduct rules setting out what satisfies the duty in specific circumstances [8], the onus is entirely on the broker’s professional expertise to structure an optimal deal. Failure to provide appropriate, profitable, and compliant financing is not a statutory compliance breach but a professional failure, leading to profound reputational damage and loss of trust [User Query].

B. Mastering Asset Security: The Personal Property Securities Act (PPSA)

Critical Takeaway: PPSA Compliance

For commercial brokers involved in asset-based lending (ABL) and equipment finance, the Personal Property Securities Act (PPSA) is the most critical piece of legislation governing security outside of land titles.[11] The PPSA defines how security interests in “personal property” (e.g., inventory, receivables, or machinery) are perfected and prioritized.[11]

- Perfection is Mandatory: For a lender’s security interest to be legally enforceable against third parties, it must be correctly registered on the Personal Property Securities Register.[11, 5]

- Risk of Failure: Failure to properly register an interest exposes the lender to losing their priority over the assets, potentially rendering the loan effectively unsecured and vulnerable to competing claims.[11]

- Broker Role: PPSA compliance is the operational step that validates the secured nature of the loan. A professional commercial broker must treat PPSA registration as essential to the integrity of the transaction.

C. Future Compliance Landscape: Fintech and Automation

The regulatory environment is also being shaped by rapid technological change. Fintech and AI-based solutions are increasingly deployed to streamline mandatory compliance procedures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks . Automated monitoring of transactions in real-time ensures swift, error-free regulatory adherence, reducing the cost of compliance and decreasing the risk of regulatory audit or fines .

While technology improves processing speed and accuracy across compliance and transaction execution, the inherently complex, relationship-based nature of commercial lending remains paramount.[1, 12] Complex commercial deals rely heavily on personal connections, robust dialogue, and proactive communication between the broker and the lender.[1, 12] Technology serves as a tool to automate commodity tasks, freeing the expert broker to focus on the high-value activity of strategic advocacy and negotiation .

IV. Mastery of Loan Structuring: Securing Capital for Business Growth

Mastery of commercial finance is defined by the ability to move beyond simple product recommendation to the strategic structuring of capital. This involves precisely matching the client’s operational demands, asset profile, and risk tolerance with specialized lending solutions. The core challenge is balancing the cost of capital with acceptable security and term requirements, ensuring the structure supports, rather than strains, the business’s strategic objectives.

A. Foundational Structuring Principles: Secured vs. Unsecured

The initial structuring decision revolves around the distinction between secured and unsecured lending, a choice that fundamentally dictates risk exposure and borrowing limits.

- Secured Loans: Require specific security (property, equipment) . Reduced risk for the lender results in lower interest rates, higher potential borrowing limits, and longer repayment terms . Mandatory PPSA compliance for non-property collateral.[11]

- Unsecured Loans: Rely on the borrower’s creditworthiness and cash flow history . Elevated risk results in higher interest rates, lower borrowing limits, and shorter repayment periods . Benefits include faster approval and flexibility for start-ups .

Table 2 highlights the structural implications of security type:

| Characteristic | Secured Loans | Unsecured Loans | Structural Impact |

|---|---|---|---|

| Primary Security | Property, Equipment, Business Assets | Borrower Creditworthiness & Cash Flow | Dictates interest rate margin and LVR. |

| Typical Cost of Capital | Lower | Higher | Reflects the degree of lender risk exposure. |

| PPSA Relevance | High (for personal property collateral) [11] | Minimal | Determines the necessary legal due diligence and compliance steps. |

B. Specialized Product Deep Dive

The professional commercial broker must be facile with a spectrum of specialized commercial products beyond standard commercial property mortgages :

- Asset-Based Lending (ABL): Leverages specific assets (inventory, receivables, machinery) to secure funding . Requires deep knowledge of asset valuation and rigorous PPSA registration .

- Development Finance: Highly complex, high-risk structuring centered on projected end values, construction cost assessments, and exit strategies . Critical for leveraging current infrastructure and housing growth.[4]

- Working Capital Solutions: Short-term facilities including Invoice Finance (converting receivables into immediate cash) and Trade/Import Finance .

- Equipment Finance: Acquisition of machinery, vehicles, and technology, inherently subject to PPSA governance .

C. Structuring for Optimal Client Outcomes

The ultimate measure of structuring mastery is the broker’s ability to synthesize these elements—for example, combining a commercial property loan with specialized equipment finance and a business overdraft—to create a unified capital solution. This process requires expert negotiation of critical clauses, including specific loan terms, interest mechanisms, repayment covenants, and default provisions, all while ensuring compliance with relevant Australian guidelines .

V. The Rigorous Client Needs Assessment Framework

In the commercial domain, the client needs assessment must transcend simple verification of capacity. It must function as a rigorous financial and operational viability audit, determining not only if the business *can* afford the debt but whether the debt structure is optimal for sustained enterprise success. This process is structured in three phases: strategic profiling, financial statement mastery, and operational efficiency evaluation.

A. Phase 1: Strategic Business Profiling and Risk Identification

The assessment begins by moving beyond the financial data to understand the commercial context. This profiling phase requires documenting core business goals, mapping them against the proposed finance structure, and identifying critical industry-specific risks.[2] A broker must understand market cyclicality, supply chain dependencies, management experience, and whether the client’s industry aligns with the current selective appetite of the major lenders (e.g., assessing the preference for Industrial/Logistics assets).[4]

B. Phase 2: Financial Statement Mastery (The Commercial Broker’s Toolkit)

While Profit & Loss (P&L) statements indicate profitability, the Cash Flow Statement is the single most important document for assessing immediate debt serviceability.[13] A commercial broker must be able to demand and interpret a structured cash flow forecast—an estimate of future sales and costs—which helps predict shortages or surpluses over the projected term of the loan.[3, 13]

The Centrality of Cash Flow Forecasting

The structured commercial cash flow forecast requires several key components for integrity and accuracy:

| Component | Required Data Element | Purpose in Needs Assessment |

|---|---|---|

| Starting Point | Opening Bank Balance [3] | Establishes the initial baseline of liquidity.[13] |

| Cash Incoming | Sales, Debtor Receipts, Grants (Actual/Estimated) [3] | Assesses reliability and seasonality of revenue generation. |

| Total Incoming | Sum of all Cash Incoming items [3] | Measures total funds available for the period. |

| Cash Outgoing | Operating Costs (Rent, Utilities, Wages, Purchases) [3] | Evaluates the necessary fixed and variable cost burden. |

| Closing Balance | Opening Balance + Total Incoming – Total Outgoing [3] | Predicts future liquidity and ability to cover monthly payments. |

| Data Integrity Check | Clear labeling of estimated figures and GST inclusion/exclusion status [3, 13] | Ensures transparency and accurate calculation of true operational flow. |

C. Evaluating Operational Efficiency (The Hidden Risk)

A deeper analysis extends beyond the static figures of the cash flow statement to assess the client’s internal financial management systems. Poor operational habits can introduce unnecessary volatility into cash flow, making a profitable business appear high-risk to a lender.

The broker’s due diligence should incorporate an operational efficiency audit, checking specific client behaviors that dictate the speed of cash conversion.[10] Essential questions include: Does the client use an up-to-date cloud accounting system? Is bookkeeping current (at least monthly)? Does the client follow up on overdue accounts promptly via phone or email? Do they actively run Aged Receivables Reports weekly?[10]

A business that is slow to invoice or lax in debt collection introduces self-imposed risk through volatile cash flow, even if its underlying business model is sound. By stabilizing the client’s cash flow profile—perhaps by structuring temporary invoice finance or recommending stronger internal controls—the broker successfully lowers the perceived lending risk and improves the overall attractiveness of the primary loan application.[10]

VI. Conclusions and Strategic Recommendations

The successful entry into commercial finance necessitates a profound departure from the residential lending framework. The path to achieving expertise and credibility requires a deliberate, multi-faceted strategy centered on formal accreditation, specialized conceptual mastery, and rigorous analytical discipline.

The Integration of Professionalism and Relationship

The current commercial boom, evidenced by a 31% YoY increase in settled loan values to $22.69 billion [1], presents substantial opportunities, but the market demands specialization. The cornerstone of this professional transition is the formal certification provided by the CAFBA PACE Premium education program, which equips brokers with expertise in essential domains such as loan structuring, risk assessment, and regulatory adherence.[2] This formal training is critical not only for technical competence but also as a strategic credential, often mitigating the requirement for two years of commercial experience when seeking immediate panel accreditation with selective lenders.[6]

Final Strategic Mandates for Success

To achieve mastery and secure competitive advantage in the Australian commercial finance sector, the transitioning broker must adhere to three non-negotiable strategic mandates:

- Embrace Regulatory Specificity: Mastery of the Personal Property Securities Act (PPSA) is mandatory for any involvement in asset-based lending or equipment finance, as failure to correctly register a security interest exposes the entire transaction structure to critical legal risk.[11]

- Focus Expertise on High-Demand Sectors: Align professional expertise, particularly in development finance, with the sectors currently favored by selective lenders. The high preference for Industrial/Logistics and Residential Development assets suggests these sectors offer the greatest potential for streamlined deals and strong returns in the immediate term.[4]

- Implement Cash Flow Analysis as the Core Diagnostic Tool: The broker must be capable of auditing the client’s operational efficiencies, using tools like the structured cash flow statement [3, 13] to identify and mitigate risks associated with poor debtor management or inefficient cash conversion cycles.[10]