Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

This audio version covers: Macquarie’s Halt on Trust and Company Loans: A Broker’s Roadmap to the New Lending Landscape

Macquarie’s Exit from Trust Lending: Brokers Weigh In on ‘Loophole’ Crackdown and Market Reshuffle

In a significant move that has sent ripples through the mortgage industry, **Macquarie Bank** has announced it will pause all new home loan applications where the borrower is a trust or a company, effective from 31 October.

This decision has ignited a major discussion among brokers, with reactions ranging from concern over the impact on legitimate investors to describing it as a necessary **”pushback against loophole-driven lending.”**

The “Why”: Spruikers and Impending Regulation

The reasons for Macquarie’s exit are twofold, addressing both market behavior and future compliance obligations. The bank’s communication pointed directly to a confluence of online influence and impending regulation.

Problem 1: Social Media ‘Spruikers’

Macquarie cited the **”emergence of strategies on social media aimed at maximising lending through trusts and companies”** as a reason for the decision. This trend encourages borrowers to use complex structures to bypass serviceability limits, a tactic that has “raised red flags across the sector for a long time.”

— Eva Loisance, Principal at FinniEmerge Finance director **Adam Bradley** noted that while there are “influencers or people trying to muck around with the system,” he believes “for the most part, I think everyone’s doing the right thing.”

The second driver is the upcoming **anti-money laundering (AML) Tranche 2 regulations**. These rules will require additional, complex verification steps for trust and company loans, making the origination process significantly more complex and time-consuming for all parties involved.

A “Necessary Reshaping” or “Worse Outcome”?

Broker opinions are divided, reflecting the tension between maintaining responsible lending standards and accommodating legitimate investor strategies.

The Strategy Reshape

Viewing the move as structural simplification.

Eva Loisance believes the shift will **”reshape investor behaviour and broker strategies,”** potentially reducing borrowing capacity or forcing clients to move to personal-name lending for asset protection and tax planning clients.

Matt Turner, GSC Finance Solutions, viewed the exit as a major industry change and noted it aligns with Macquarie’s previous **”simplification of their loan book,”** referencing their pull-out from asset finance last year.

The Customer Impact

Focusing on the loss of a specialist product.

**Xavier Quenon** of Go Mortgage Brokers called it a “shame” that a specialist lender is leaving the space, noting that the combination of influencer concern and regulation means **”the red tape will generate worse outcome for customers.”**

Adam Bradley lamented the reason, stating, “But for the most part, I think everyone’s doing the right thing,” and criticized the shock and speed of the policy change.

Will Other Lenders Follow Suit?

The market is now watching closely. Does Macquarie’s exit indicate a broader tightening, or will other lenders seize the opportunity?

Scenario Analysis: Follow vs. Feast

- **The Follow:** Matt Turner and Eva Loisance both believe more lenders will follow, or at least **”apply more scrutiny”** by introducing stricter documentation, higher servicing buffers, or limiting LVRs.

- **The Feast:** Adam Bradley sees a clear market opportunity, stating, “I’ve already talked to some lenders who have said they are now talking internally about how they can improve their credit policies to try and **soak up some of that business**.”

The Immediate Impact on Broker Operations

For brokers whose investor clients commonly use trusts, the fallout is both logistical and strategic.

**Significant Volume Loss:** For Go Mortgage Brokers, Xavier Quenon estimated that his brokerage **”probably send 20–25 per cent of our trust loans to Macquarie,”** meaning an immediate and significant need to find a replacement partner.

The immediate challenge is managing clients with applications in the pipeline. Adam Bradley noted the speed of the change was “quite a shock,” forcing brokerages to **”pivot”** which is “not ideal from a customer experience perspective.”

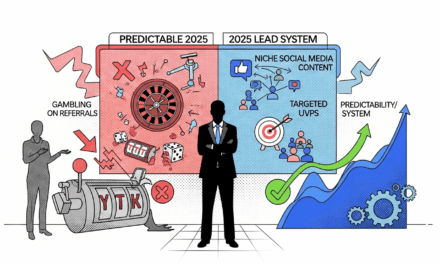

Broker Opportunity: Step Up as the Trusted Expert

The turbulence creates a clear demand for brokers to provide high-level, structural advice.

“As a broker I see an opportunity to debunk myths, guide clients through structural choices, and highlighting the importance of responsible lending.”

— Eva Loisance, FinniStay sharp and informed. We’ll be tracking the lenders who step up to fill this gap.

Read More Industry Updates