Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

This audio version covers: The Holistic Pivot: How to Leverage DBFO Reforms to Bridge the Credit-Advice Gap in 2026

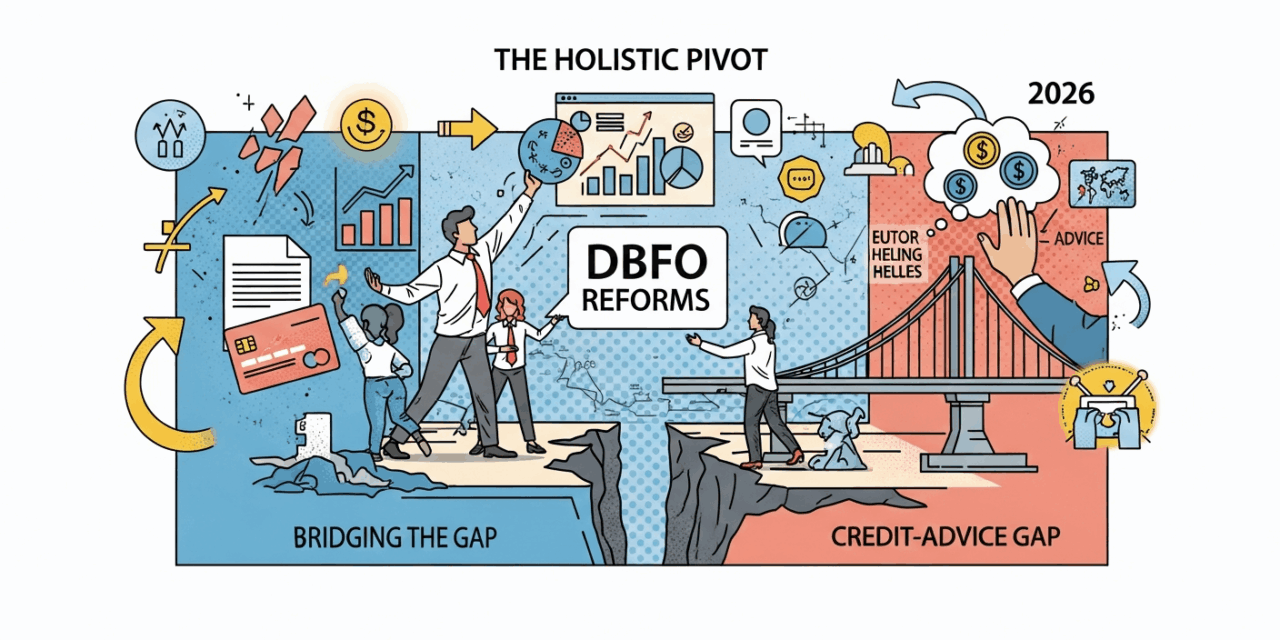

The Holistic Pivot: How to Leverage DBFO Reforms to Bridge the Credit-Advice Gap in 2026

The Australian mortgage broking industry has reached a watershed moment in 2026. As the mortgage broker market share for new residential lending hovers at a record high of 77.6% [1, 2], the traditional boundaries between credit assistance and financial advice are dissolving. This article explores how principal brokers can pivot toward a “Private Wealth” model, addressing the profound structural deficit in the Australian economy: the “advice gap”.[3]

1. The DBFO Regulatory Framework

The “Delivering Better Financial Outcomes” (DBFO) package represents a fundamental recalibration of financial advice laws, shifting from “disclosure-heavy” to “principles-based” regulation.[4]

Tranche 1: Removing Administrative Friction

Tranche 1 focused on eliminating the “red tape” that hindered scalability. The abolition of the Fee Disclosure Statement (FDS) has been replaced by a streamlined, consolidated client consent process for ongoing fee arrangements (OFAs).[4, 5] Brokers now utilize 150-day windows to obtain consent via a single form that looks forward to the next 12 months.[5]

Tranche 2: The CAR and the Qualified Adviser

The Statement of Advice (SOA) has been replaced by the **Client Advice Record (CAR)**.[6] The CAR is designed to be “fit-for-purpose”—clear, concise, and written in plain English.[6] Parallel to this is the introduction of the **”New Class of Adviser” (NCA)**.[7, 8] These advisers require an AQF level 5 diploma and are restricted to providing “simple advice” on prudentially regulated products like insurance and basic superannuation.[3, 8]

CAR Content Requirements

- Identification: Must include the words “client advice record”.[6]

- Scope: Clear definition of advice boundaries.[6]

- Rationale: Explanation of how advice meets client objectives.[6]

- Disclosures: Full cost of advice and any benefits received.[6]

2. The 2026 Australian Advice Landscape

The “advice gap” is most acute among middle-market Australians. The number of licensed financial advisers has nearly halved since late 2018, falling to just under 15,500 in late 2025.[3] Meanwhile, median advice fees have escalated by 18% to A$4,668.[3]

| Metric | 2024 (Sept) | 2025 (Sept) | Trend |

|---|---|---|---|

| Broker Market Share (%) | 74.6% | 77.3% | Up 2.7pp [1] |

| Settled Loan Volume ($B) | $103.23B | $130.23B | Up 26.1% [1] |

| Median Advice Fee (A$) | $3,950 | $4,668 | Up 18.2% [3] |

3. Pillars of the Private Wealth Model

Transitioning to a holistic model requires shifting from transaction-centric to relationship-centric operations.[9]

Pillar 1: Holistic Debt Strategy. Move beyond interest rates. Utilize **Strategic Loan Structuring** to maximize tax efficiency through debt recycling and advanced cash flow modeling.[10, 11]

Pillar 2: Addressing Unmet Demand. Brokers are expanding into high-margin segments like **SMSF Lending** and commercial finance.[10, 12] DBFO reforms allow super trustees to charge advice fees from a member’s super account, facilitating intra-fund advice.[4, 5]

Pillar 3: Integrated Service Offerings. Successful brokers act as “General Practitioners,” coordinating with legal and tax specialists.[13, 14] Referral synergies with financial planners allow brokers to implementation debt structures that free up cash flow for the planner’s recommendations.[15]

4. Operationalizing the Pivot

The administrative burden of a Private Wealth model is offset by the “Agentic AI” revolution of 2026.[16, 17]

AI Integration in the 2026 Workflow

- Generative AI (GenAI): Automates the drafting of Client Advice Records.[16, 18]

- Intelligent Document Processing (IDP): Extracts data from tax returns and bank statements to identify inconsistencies.[19, 18]

- Agentic AI: Proactive systems that coordinate between lender, solicitor, and broker autonomously.[17]

5. ASIC Priorities and Compliance

While DBFO reduces red tape, ASIC monitoring has intensified. In 2026, ASIC is conducting its first dedicated monitoring of **Best Interests Duty (BID)** since its 2021 introduction.[20, 21]

ASIC 2026 Enforcement Priorities:

• Poor private credit practices.[22]

• Misleading pricing and renewal comparisons.[22, 23]

• Misconduct exploiting consumers in financial difficulty.[22, 24]

• Failure to identify “red flags” for fraud.[25]

6. The 2026 Principal Broker Checklist

- Value Proposition: Refresh marketing from “best rate” to “Financial Wellbeing”.[9]

- The NCA Pathway: Identify junior staff for AQF level 5 diploma enrollment to provide simple advice.[7, 8]

- Partnership Formalization: Establish formal referral agreements with planners and estate lawyers.[26, 9]

- Governance: Conduct internal audits of recommendation rationale to ensure BID compliance.[27, 28]

The Future is Holistic

The 2026 market rewards brokers who combine strategic focus with operational excellence. By pivoting toward a Private Wealth model, you secure your role as a trusted advisor in a credit-advice continuum.

Download Your Strategy Guide

© 2026 The Broker Times. Prepared for Educational Use.

Citations: [1, 3] are based on Internal Research Material.