Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

This audio version covers: The Turnover Trap Why Resilient Prices Won’t Save Your Pipeline (And How to Pivot to Database Nurturing)

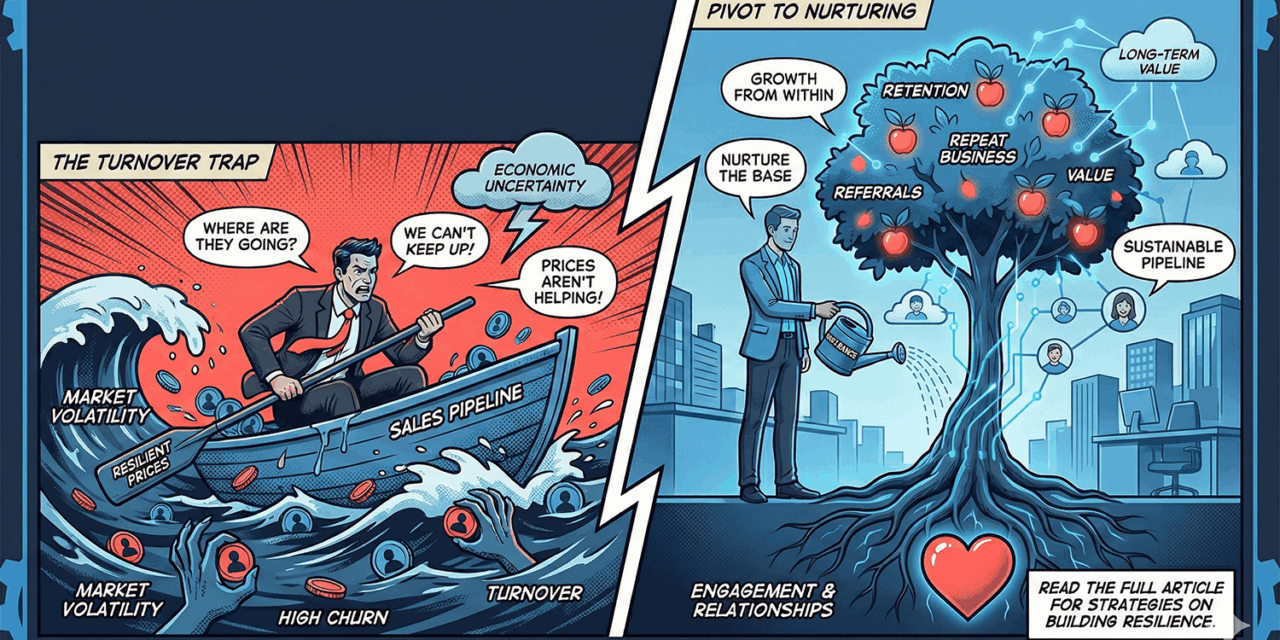

The Turnover Trap: Why Resilient Prices Won’t Save Your Pipeline

The Australian residential mortgage landscape in 2026 is defined by a paradoxical decoupling of asset valuations and transaction liquidity. While national median house prices have reached a robust $973,000, underlying health is threatened by the “Turnover Trap.” [1, 2] High equity exists alongside suppressed volume as homeowners are “locked in” by restrictive credit and the RBA’s 3.85% cash rate environment.

Article Strategy Guide:

Step 1: The Macroeconomic Landscape

Housing market momentum accelerated sharply in the second half of 2025, with capital city house values rising 7.7%.[1, 3] However, this price strength masks a structural deficit: national inventory levels are 17.8% lower than 2025. Prices are high because nothing is for sale, not because credit is flowing freely.

| Capital City | House Price Growth (%) | Vacancy Rate (Jan 2026) |

|---|---|---|

| Perth | 12.8% | 0.6% |

| Brisbane | 10.9% | 0.9% |

| Darwin | 10.5% | 0.8% |

| Adelaide | 8.2% | 0.8% |

| Melbourne | 6.8% | 1.7% |

| Sydney | 5.8% | 1.5% |

Step 2: The Monetary Policy Pivot

On February 3, 2026, the RBA increased the cash rate to 3.85% to combat persistent inflation. This move has added approximately $83 a month to repayments on a $500,000 mortgage. For brokers, this means advising on debt reduction and cash-flow management is now more critical than simply securing the highest loan amount.

Note: By March 2026, over 1.3 million mortgage holders are projected to be “At Risk” of mortgage stress.[4, 5]

Step 3: Navigating APRA’s DTI Limits

Effective February 1, 2026, APRA introduced formal quantitative caps on high Debt-to-Income (DTI) lending.[6, 7, 8] ADIs must now limit mortgages where total debt is at least six times income to no more than 20% of new lending.

Strategic Adjustment for Brokers

Lenders approaching their 20% quota quarterly may tighten internal criteria mid-period.[6, 9] Brokers should calculate DTI early for every lead and prepare for increased scrutiny on non-standard income and “add-backs.”[7, 8]

Step 4: Breaking the “Mortgage Prison”

While the standard buffer remains at 3.0%, banks like Westpac and CBA now apply exceptions for borrowers seeking to refinance with a strong repayment history—reducing the buffer to just 1.0%.

| Metric | Standard 3% Buffer | 1% Buffer Exception |

|---|---|---|

| Stress Test Rate (est) | 9.44% | 7.44% |

| Borrowing Capacity | ~$950,000 | ~$1,400,000 |

| Qualification | LVR < 80% | Flawless 12-mo credit history |

Step 5: Pivoting to Database Mining

In a transactional drought, brokers must transition from “hunters” to “farmers.”[7, 10] A successful 12-month nurture sequence focuses on providing monthly value without a hard sell, positioning the broker as a long-term property partner.[11, 12]

12-Month Nurture Roadmap:

- Months 1-3: Local market snapshots and neighborhood trends.[11, 12]

- Months 4-6: Credit health check-ups and “borrower ready” tips.[7, 11]

- Month 10: Fixed-rate expiry preparation (starts 70 days out).[7, 13]

- Month 12: Annual strategic goal review.[11, 12]

The “Human Edge”: Effective March 4, 2026, the ban on “trigger leads” prevents credit bureaus from selling your client info to competitors.[14, 15, 4] This protects your database, making it your firm’s most secure asset.

Broker Strategic Takeaway

The “Turnover Trap” is a permanent shift. The path to a sustainable pipeline lies in moving away from the “one-and-done” transaction. Audit your database today for “Mortgage Prisoners” who can benefit from 1% buffer exceptions.

Download the Nurture Sequence Template