Too Busy to Read? We’ve Got You.

Get this blog post’s insights delivered in a quick audio format — all in under 10 minutes.

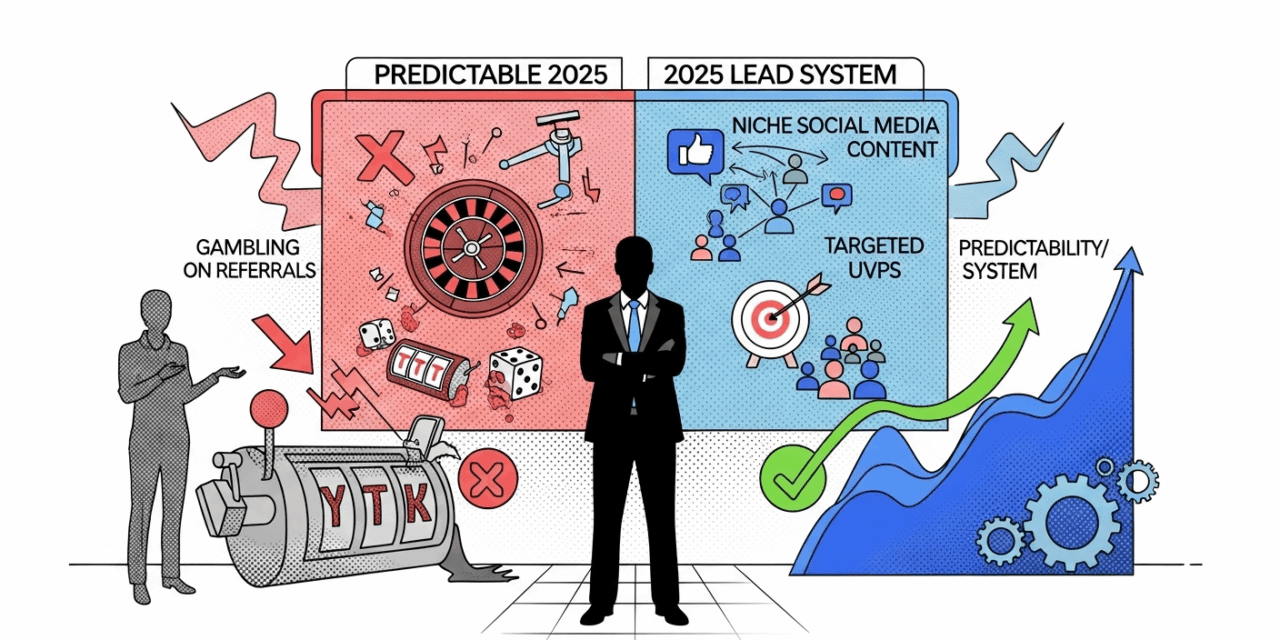

This audio version covers: Stop Gambling on Referrals: Building a Predictable 2025 Lead System with Niche Social Media Content and Targeted UVPs

Stop Gambling on Referrals: Building a Predictable 2025 Lead System with Niche Social Media Content and Targeted UVPs

The Australian mortgage broking industry is entering a highly transformative and competitive era. For many brokerages, sustained growth relies heavily on established passive sources, specifically repeat customers (44%) and referrals (28%).[1] While these lead types convert exceptionally well, relying solely on them creates a volume ceiling and introduces significant unpredictability, effectively turning business growth into a reliance on chance rather than strategy.

Achieving sustainable, scalable growth in 2025 demands a proactive shift toward an intentional, predictable lead generation system. This system is predicated on three core pillars: **Specialisation** (defining a niche Unique Value Proposition, or UVP), **Scalability** (implementing compounding Synthetic Lead Flow), and **Stewardship** (ensuring strict ASIC compliance across all digital channels).

Brokers who successfully navigate this transition will move beyond being mere “matchmakers” between borrowers and lenders.[2] By harnessing specialist knowledge and leveraging transformative technology, these professionals will outpace their generalist competitors and position themselves as strategic financial advisors.[2, 1]

Article Navigation: Quick Guide to Predictable Growth

- Step 1: The Predictability Deficit: Why Referrals Alone Are a Growth Liability

- Step 2: The Foundation: Architecting a Rock-Solid Unique Value Proposition (UVP)

- Step 3: Designing the Predictable Lead System (PLS) Framework

- Step 4: High-Impact Niche Content and Social Channel Strategy

- Step 5: Compliance and Governance: Ensuring Your Content is Regulator-Ready

- Step 6: Leveraging AI and Automation for Predictability in 2025

- Step 7: Measuring Success: KPIs for Scalable Lead Generation

Section 1: The Predictability Deficit: Why Referrals Alone Are a Growth Liability

1.1 The Illusion of Security: Organic vs. Synthetic Flow Dynamics

A successful modern brokerage operates two distinct but interconnected lead channels. The first, Organic Lead Flow, comprises repeat clients and referrals from existing networks and partners.[3] This flow is highly prized because it converts “like crazy” due to the built-in trust and social proof accompanying a personal recommendation.[3] However, this strategy is inherently hard to scale and lacks predictability; a broker cannot simply “turn a dial” to generate an immediate surge in referral volume when needed.[3]

The second channel, Synthetic Lead Flow, encompasses proactive strategies such as paid advertisements, content marketing, and networking events—activities that require an investment of time or money to introduce new people to the brokerage.[3] Although synthetic channels typically yield relatively lower initial conversion rates because prospects have no prior relationship with the broker, they offer the crucial elements of scalability and predictability. When structured correctly, a broker can invest more time or money and receive more leads.[3]

The Compounding Lead Cycle

The solution to scaling referrals lies in understanding the synergy between these two flows. Synthetic efforts serve as the engine, bringing fresh, high-quality clients into the broker’s universe. Once engaged, the broker delivers the high standard of service and expertise expected under the Best Interests Duty (BID).[1] This excellent service then generates new organic lead flow (referrals) from those synthetically acquired clients, creating a compounding, self-sustaining cycle that solves the inherent scalability deficiency of traditional referral models.[3]

1.2 The Lead vs. Prospect Conundrum

A common operational bottleneck for brokers is mistaking a conversion problem for a lead generation problem.[4] Understanding the difference between a lead and a prospect is essential for efficient time management. A lead is simply a top-of-funnel point of contact—a name, email, or phone number gathered after a generic response to marketing.[4] Leads represent potential but require significant effort for qualification. Conversely, a prospect is a qualified opportunity: a lead that has been vetted and possesses the necessary capability and time frame to take action; they are “buy-ready”.[4]

The contemporary market is often flooded with low-quality leads captured using questionable tactics, which can become a massive time sink for busy brokers.[4] In the current Australian climate, characterised by heightened cost-of-living pressures, ASIC’s enforcement priorities include addressing misconduct that exploits consumers and impacts small businesses.[5] This regulatory emphasis demands that brokers focus their limited time and resources on high-quality engagement. By targeting and nurturing qualified prospects, brokers align their professional efforts with the intent of the Best Interests Duty (BID) [1], ensuring valuable time is spent assisting clients who genuinely require and are ready for complex financial solutions.

Section 2: The Foundation: Architecting a Rock-Solid Unique Value Proposition (UVP)

2.1 Moving Beyond Generic Claims: The Differentiation Dilemma

In a crowded marketplace, differentiation is non-negotiable for success.[6, 7] Generic claims such as offering “the best rates” or “better service” are largely meaningless to consumers because, fundamentally, all brokers access a similar panel of lenders and follow comparable application processes.[7] These promises fail to establish a competitive advantage.

Instead, long-term success requires defining a strong personal brand built upon a clearly articulated UVP.[6] This UVP must transcend basic service claims, highlighting the unique combination of skills, experiences, and specific value the broker brings to a select client audience.[6] A specialised focus makes it significantly easier and cheaper to gain market traction compared to operating as a generalist.[8]

2.2 Framework 1: The UVP Formulation Model

Structured UVP Refinement Lenses

A structured approach helps brokers move past generic statements to craft a succinct, compelling UVP. This approach uses several focused lenses to refine the offering [8]:

- PROSPECT: Define a highly specific target audience (e.g., medical professionals, property investors, or regional business owners).[8]

- PROBLEM: Identify the deep, specific pain points unique to that prospect. This goes beyond the surface need for a loan and addresses the underlying anxiety (e.g., complex serviceability issues for self-employed clients).[8]

- PROMISE: Communicate unique guarantees that solve the specific problem better than a generalist or a traditional bank.[8]

- PROOF: Provide tangible evidence, such as testimonials and case studies, that specifically support the unique promise for that niche.[8] Proof from a first home buyer, for instance, is irrelevant for an investor specialist’s UVP.[8]

- PROPOSITION: Detail the unique packaging and presentation of the service, often including marketing offers and a technology-backed, streamlined client experience.[8]

2.3 Deep Dive: Specialisation Approaches with Australian Examples

Specialisation can be successfully implemented through three primary methods, turning general knowledge into targeted attraction [8]:

- Focusing on a Specific CUSTOMER: Tailoring the entire brokerage structure to serve a unique client persona.[8] Australian examples include brokers like Fedi El-Daher, who specialises in first home buyers, Alex Krzystoszek, the medico finance advocate, or Dean Freda, known as the tradie’s champion.[9, 10] Positioning a business around clients facing specific personal situations, such as supporting divorcees, is also a powerful niche.[10]

- Focusing on a Specific PRODUCT Category: Specialising in loan types that require intensive knowledge of specific lender policies.[8] Examples include Self-Managed Superannuation Fund (SMSF) loans, complex building and construction finance, or commercial property loans.[8]

- Focusing on an Integrated STRATEGY: Positioning the service around a long-term financial objective.[8] This could include strategies like rapid mortgage reduction, complex investment property accumulation plans, or structured debt freedom pathways.[8]

Specialising in a client segment inherently strengthens the broker’s capacity to fulfil the requirements of the Best Interests Duty (BID) [1], providing a clear regulatory advantage over generalists.

Table 4: UVP Specialisation Matrix & Example Niche Messaging

| Focus Area | Target Niche Example | Specific Client Pain Point | UVP Promise (Non-Generic) |

|---|---|---|---|

| Customer | Self-Employed Business Owners | Complexity proving variable income/cash flow when banks prefer PAYG applicants. | We design documentation strategies that convert complex financials into bank-ready applications, securing funding aligned with your business structure. |

| Product | Building Loans & Construction | Managing stage payments, valuation delays, and ensuring seamless progress draws. | Specialised construction loan management ensuring funds are disbursed on schedule, mitigating delay penalties. |

| Strategy | Rapid Investment Portfolio Growth | High LVR strategies while maintaining serviceability across multiple lenders. | Our 5-year leverage plan maps out asset acquisition and rapid debt recycling tailored specifically for portfolio scaling. |

Section 3: Designing the Predictable Lead System (PLS) Framework

3.1 Establishing the Compounding Lead Cycle

The Predictable Lead System (PLS) is a machine designed to convert low-trust synthetic interest into high-trust, qualified prospects who will eventually compound into future organic referral sources.[3, 6] Establishing this compounding cycle requires defined and measurable components: high-converting lead magnets, a targeted content strategy, automation system setup, effective follow-up sequences, and robust ROI tracking.[6]

3.2 Lead Magnet Development for Niche Qualification

Effective Lead Magnet Ideas for the 2025 Market

Content serves as the primary qualifier, ensuring that the contacts attracted are high-quality, pre-qualified prospects already wrestling with the specific niche problem the broker solves [4, 9]:

- FHB Niche: Given the success of government schemes, a highly effective magnet could focus on guides detailing access to the First Home Guarantee Scheme (HGS) and how to save on Lenders Mortgage Insurance (LMI), which can cost a first home buyer around $25,000.[3]

- Investor Niche: Investors require forward-looking strategic content. A guide analysing the 2025 interest rate outlook (where Commonwealth Bank and ANZ anticipate the cash rate falling to around 3.35% by the end of 2025, while Westpac is more conservative) provides valuable, timely data for decision-making .

- Self-Employed Niche: A checklist detailing how to structure complex financials to meet specific complex lender criteria acts as an immediate problem-solver and qualifies the lead as genuinely self-employed and actively seeking finance.

3.3 The Necessity of Automated Nurturing

A common failure point in lead generation is the inability to effectively manage clients who are interested but “not ready” to transact immediately.[11, 6] A predictable system must incorporate automation sequences to nurture these contacts consistently, preventing them from falling through the cracks or migrating to a competitor.[6, 11] This process can be significantly enhanced by leveraging AI tools capable of handling intelligent lead scoring and personalised, automated follow-up campaigns.[12] This technology allows the broker to prioritise and focus on “buy-ready” prospects, maintaining relationship warmth with those still researching.[12]

Section 4: High-Impact Niche Content and Social Channel Strategy

4.1 Platform Alignment: Tailoring Content to the Audience

Effective social media utilisation requires aligning the content style and message with the platform’s audience and purpose . Content created for one platform should rarely be replicated wholesale for another.

Platform Strategies for Maximum Cut-Through

- LinkedIn: The Professional Authority Platform: This channel is optimal for B2B development, professional networking, and forging relationships with key partners like accountants and financial planners . Content should focus on long-form industry insights, technical articles, and complex deal structuring examples. Leveraging the personal LinkedIn profile is often more effective than focusing solely on a generic business page.[9]

- Instagram & TikTok: Visual Education and Trust for Younger Demographics: These platforms are critical for reaching First Home Buyers (FHBs) and younger demographics . Content must be highly visual, using short-form video (Reels, TikToks) to demystify finance jargon and share actionable mortgage tips in a relatable, engaging way . Infusing the content with the broker’s unique personality and story is crucial for increasing cut-through.[13]

- Facebook: Community and Targeted Advertising: Facebook remains an essential tool for community engagement, sharing local market updates, and deploying targeted paid advertising campaigns focused on specific local niches or demographics .

The migration to digital channels necessitates that brokers consciously develop a personal brand.[13] This is vital because clients acquired via Synthetic Lead Flow begin with low trust.[8] By infusing personality and storytelling, the broker dramatically accelerates the process of earning trust and credibility, thereby reducing the time and effort required to convert a cold contact into a qualified prospect.[13]

Table 5: Strategic Social Media Channel Deployment

| Platform | Primary Niche Target | Goal/Function | Required Content Style | Key Compliance Focus (ASIC) |

|---|---|---|---|---|

| Accountants, Solicitors, Experienced Investors | B2B Referrals, Authority Building | Technical articles, Industry Insights, Complex Deal Analysis | Accurate financial claims, Disclosure of potential conflicts.[14] | |

| First Home Buyers (Gen Y/Z), Younger Clients | Brand Trust, Financial Education | Visual, Short-form Video (Reels), Infographics | Avoiding misleading claims regarding savings/returns (RG 234).[11, 15] | |

| TikTok | Early-stage Property Curious, Gen Z | Virality, High-Volume Awareness | Short, entertaining/educational videos, Personality-driven storytelling | Clear distinction between information and specific financial product advice (INFO 269).[14] |

| Local Community, Targeted Demographics | Community Engagement, Paid Lead Generation | Educational updates, Community interaction, Local market reports | Ad transparency, accurate representation of services. |

4.2 Capitalising on 2025 Market Opportunities

Broker content should directly address the uncertainty and opportunities projected for 2025 . Content focusing on the uncertainty surrounding interest rate cycles (where major banks offer differing predictions) allows the broker to create compelling comparison content, such as “What a 0.25% cut means for your mortgage,” which drives traffic to specialised lead magnets. Furthermore, deep dives into government policy, such as the nuances of the First Home Guarantee Scheme (HGS), position the broker as the essential expert for navigating these benefits.[3]

Section 5: Compliance and Governance: Ensuring Your Content is Regulator-Ready

5.1 The ASIC Lens on Digital Finance

As brokers increasingly act as digital educators and financial communicators, they must operate strictly within the legal framework established by the Australian Securities and Investments Commission (ASIC). Information Sheet 269 (INFO 269) dictates that brokers must understand their legal obligations when discussing financial products online.[14] Posting content or promoting affiliate links may constitute providing financial product advice, which requires an Australian Financial Services (AFS) license or authorisation as a representative.[14] ASIC actively monitors digital financial discussions for misleading conduct.[14]

5.2 RG 234: Balanced Messaging and Expectations Management

Compliance Mandate: Balanced Messaging

All advertising and content must adhere to ASIC Regulatory Guide 234 (RG 234), which mandates good practice guidance to prevent misleading or deceptive conduct.[15] RG 234 requires that content for credit products, including social media posts, must give a balanced message about the features, benefits, and **risks** associated with the product.[11] It is crucial that brokers avoid overstating potential benefits (e.g., exaggerated investment returns or savings) or creating unrealistic expectations by giving undue prominence to benefits over potential risks.[11]

5.3 Managing Testimonials and Social Proof Compliantly

When deploying social proof, brokers must ensure that testimonials reinforce the *specific* promises made in the UVP.[8] Critically, testimonials, especially those regarding savings or rate reductions, must be factually supportable and cannot imply guaranteed future outcomes, which would violate RG 234’s mandate on balanced messaging and avoiding misleading claims.[11]

A broker who chooses a niche UVP inherently streamlines their compliance efforts. Generalist claims, like “We save every client money,” are broad, difficult to substantiate widely, and highly vulnerable to scrutiny under RG 234.[11] By narrowing their focus, the broker can provide specific, relevant proof that directly supports the precise claim made to their specialised audience, significantly reducing the likelihood of being found misleading or deceptive.[8]

Section 6: Leveraging AI and Automation for Predictability in 2025

6.1 The Rise of AI Prime and Agentic AI

The mortgage sector is experiencing a fundamental technological transformation referred to as “AI Prime,” where artificial intelligence is integrated deeply into decision-making, communication, and commercial processes.[16] Brokers are now leveraging “agentic AI”—systems capable of executing multi-step tasks independently, spanning from initial lead generation to automated client follow-ups.[16, 12]

6.2 AI Applications for Lead System Predictability

AI technology offers several practical applications for bolstering lead system predictability:

Practical AI Uses for Brokers

- Content Generation and Efficiency: AI tools can rapidly assist with content repurposing and draft generation, helping brokers turn a long-form article into several social media posts or streamline listing text generation while maintaining a professional tone.[12]

- Intelligent Lead Nurturing: AI platforms facilitate automated prospecting, implement sophisticated lead scoring, and manage personalised follow-up sequences.[12] This intelligent nurturing is vital for converting the high volume of synthetic leads into qualified prospects efficiently.[12, 11]

- Administrative Efficiencies: AI can handle tedious, repetitive tasks such as intelligent document processing, data extraction, and automated compliance checks on documents, freeing up valuable broker time.[12]

6.3 The Human Oversight Mandate

While embracing AI provides a competitive advantage, human oversight remains essential.[16] The adoption of technology fundamentally shifts the broker’s role from transactional administrator to complex financial problem solver and relational manager. Considering that brokers dedicate approximately 11% of their time to educating customers , automating simple information dissemination frees up that time for complex, high-value strategic advice and strengthening client relationships. This shift ensures the broker maintains human intuition and professional judgment, which are vital components of delivering services that fulfil the ethical and regulatory requirements of the BID.[17]

Section 7: Measuring Success: KPIs for Scalable Lead Generation

7.1 Shifting the Focus: From Vanity to Conversion Metrics

A predictable lead generation system demands rigorous, consistent measurement and tracking.[6, 5] Brokers must implement a system, such as a content calendar, that tracks not just surface metrics like “views” or “click-through rates,” but tangible business outcomes, most importantly, “deals won” that originated from a specific channel or content piece . The focus must shift from vanity metrics to those that directly correlate with profitable business growth.

7.2 Key Metrics for System Predictability (KPIs)

Defining key performance indicators (KPIs) based on the cost and quality of conversion ensures the system is both scalable and profitable:

Table 6: Key Metrics for Lead System Predictability

| Metric Category | Key Performance Indicator (KPI) | Why It Matters for Predictability |

|---|---|---|

| Acquisition Efficiency | Cost Per Qualified Prospect (CPQP) | Measures the true cost of attracting ‘buy-ready’ clients, moving beyond low-quality leads, essential for setting a scalable budget.[4] |

| Funnel Health | Lead-to-Prospect Conversion Rate (LPR) | Indicates the effectiveness of niche content and lead magnets in qualification and nurturing, highlighting funnel bottlenecks.[4] |

| System ROI | Lifetime Value (LTV) of Synthetic Clients | Determines if marketing spend is generating profitable long-term clients and future organic referrals, crucial for validating the compounding model.[3] |

| Engagement | Click-Through Rate (CTR) on Nurture Sequences | Measures the relevance of automated follow-up content and the depth of prospect interest.[6] |

Conclusion: The Call to Action—From Chance to Strategy

The reliance on passive referrals is a fundamentally risky business model, equivalent to gambling on market goodwill. Predictable, sustainable growth in the 2025 Australian mortgage market is not achieved by chance but through the meticulous architecting of a lead generation system. This system must be founded on laser-sharp specialisation, driven by compliant, tailored digital content, and amplified by automation technology.

The strategic challenge for every Australian mortgage broker is to transform their business by auditing their current lead flow, defining a precise UVP based on a niche (customer, product, or strategy), and building a compliant, multi-channel social media presence. By establishing a system that converts synthetic interest into high-quality prospects, and then allowing those highly serviced clients to generate new organic referrals, brokers unlock the compoundingzle necessary for genuine scalability.

Define Your Niche & Build Your Predictable System Today