Decoding Lender Policies: What Every Broker Needs to Know Right Now

The Australian mortgage market in 2025 presents a landscape of profound contradiction. On one hand, a series of cash rate cuts by the Reserve Bank of Australia (RBA) has ignited fierce competition among lenders, fuelling a surge in refinancing activity and a flurry of attractive offers for borrowers. On the other, this competitive fervour is being tempered by the unwavering gaze of regulators.

For mortgage brokers, navigating this duality is the central challenge of the current market. A superficial understanding of product rates and features is no longer adequate. Success now hinges on a deep, granular comprehension of the intricate web of credit policies that dictate which applications succeed and which fail. This intelligence briefing provides a forensic analysis of the most significant recent shifts in lender policy, designed to equip brokers with the technical knowledge required to not only navigate this environment but to excel within it.

The Regulatory Tightrope: APRA’s Stance and the New Credit Landscape

The operational parameters for every lender are fundamentally shaped by the top-down directives and forward guidance issued by Australia’s financial regulators. Recent announcements have solidified key constraints while signalling future areas of focus, setting a clear tone for risk appetite across the industry.

The 3% Serviceability Buffer: A Permanent Fixture?

APRA has unequivocally confirmed that the mortgage serviceability buffer will remain fixed at 3 percentage points above the loan’s interest rate. This decision, made in July 2025, came despite calls from industry bodies to lower the buffer in light of falling interest rates.

This stance reveals APRA’s primary focus on long-term financial stability over short-term market stimulation. The regulator is deliberately looking past the immediate relief provided by RBA rate cuts to address what it views as a core systemic vulnerability: Australia’s high level of household debt. For brokers, this creates a significant disconnect. While product interest rates are falling, the single largest constraint on a client’s maximum borrowing capacity remains locked at a level established during the peak of the rate-hike cycle.

The Shadow of DTI: APRA’s Forward Guidance as a Policy Tool

In the same announcement that confirmed the serviceability buffer, APRA issued a clear and deliberate warning about future risks. The regulator noted it is “carefully monitoring” economic conditions that have historically led to “more risky lending, such as high debt-to-income and investor lending.”

This is a calculated act of regulatory “jawboning.” By signalling its readiness and intent to deploy formal, system-wide caps on high Debt-to-Income (DTI) lending, APRA is effectively pressuring lenders to self-regulate their risk appetite in the interim. For brokers, this means the market for high-DTI loans is tightening even before APRA takes official action.

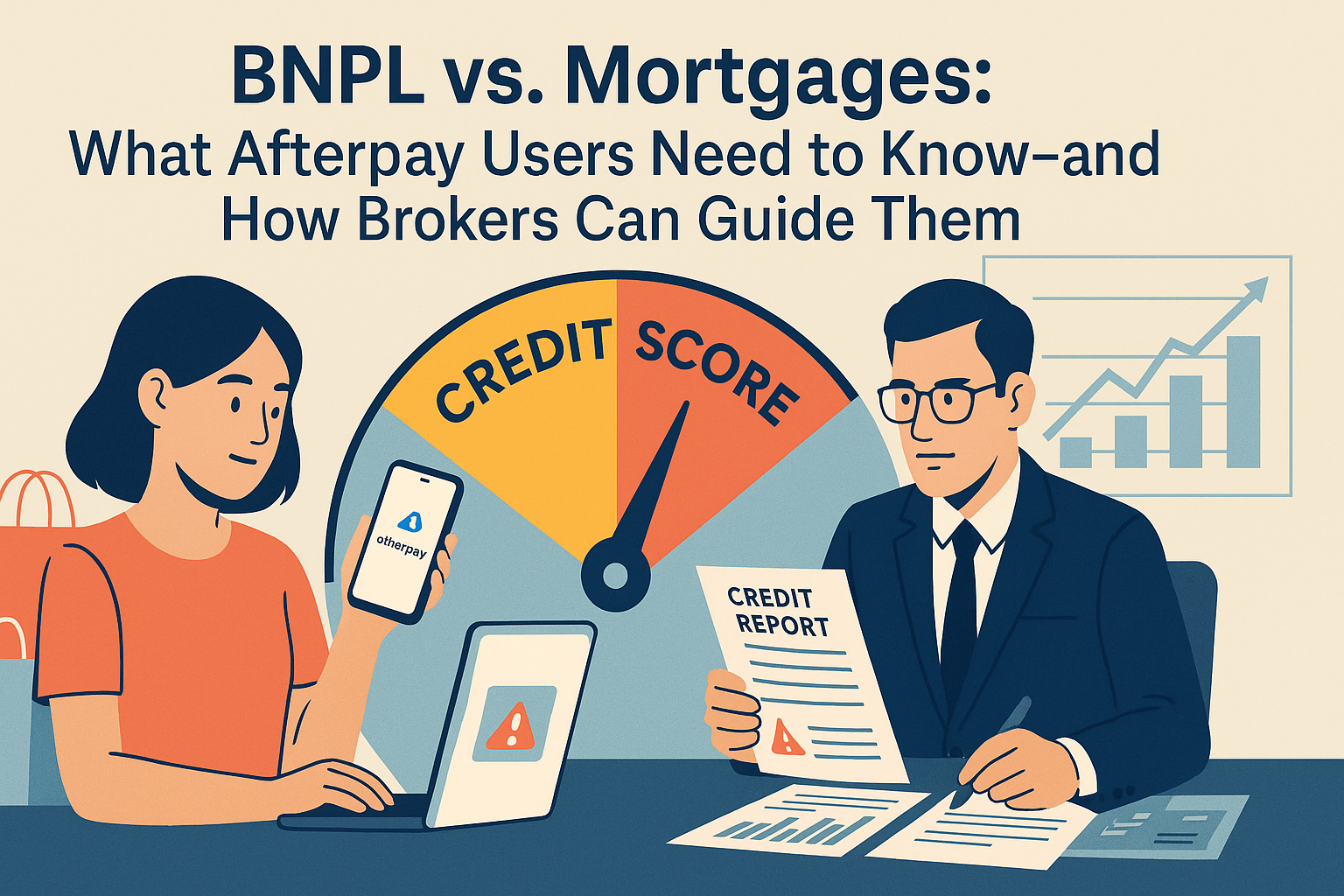

The Widening Compliance Net: BNPL and the Best Interests Duty

The regulatory landscape is also evolving at the consumer level, with two key developments converging to heighten broker responsibilities.

- Formalisation of BNPL: As of 10 June 2025, Buy Now Pay Later (BNPL) products are now formally regulated as consumer credit. This provides brokers with greater visibility over a client’s liabilities, but also formalises these debts within serviceability calculations.

- Enduring Best Interests Duty (BID): ASIC’s Regulatory Guide 273 remains the cornerstone of broker compliance, codifying the legal obligation for brokers to act in the best interests of their clients.

These two regulatory streams are now intertwined. The formal inclusion of BNPL debt in credit reporting systems transforms it from a liability that required client disclosure to one that is independently verifiable. This elevates the standard of due diligence required under the Best Interests Duty.

The New Math of Serviceability: A Forensic Look at Calculator Changes

Moving from high-level regulation to the practicalities of loan submission, the mechanics of serviceability calculators are undergoing significant shifts. Lenders are introducing new hurdles while also competing on the finer points of income assessment, creating a complex and variable landscape for brokers to navigate.

DTI as the De Facto Hurdle: The Majors Move First

In a direct response to APRA’s forward guidance, major lenders have implemented their own internal caps and referral triggers for DTI ratios, effectively creating a new primary checkpoint for high-leverage loans. The policies, however, are not uniform. This divergence reflects differing risk appetites and creates a strategic decision tree that brokers must master.

- ANZ has adopted one of the strictest stances, reducing its DTI cap and no longer accepting applications where the DTI ratio is greater than 7.5.

- National Australia Bank (NAB) appears to have the highest tolerance, with a reported DTI cap of 8 or, in some cases, 9.

- Commonwealth Bank (CBA) and Westpac have opted for a referral-based model. CBA requires applications with a DTI higher than 7 to be manually approved, while Westpac refers any application with a DTI of 7 or greater to its credit team for further review.

This fragmented policy environment means that a client’s viability is now highly lender-dependent. A broker’s value is demonstrated in their ability to immediately identify the correct lender for a client’s specific DTI profile.

| Lender | DTI Hard Cap | Referral/Scrutiny Trigger | Key Policy Notes |

|---|---|---|---|

| ANZ | 7.5x | N/A | Reduced from a previous cap of 9.0x. Applies to all home loans. |

| CBA | None specified | Manual Approval > 7.0x | Monitors applications with DTI > 4.5x. |

| NAB | 8.0x – 9.0x | N/A | Varies; reported as high as 9.0x. |

| Westpac | None specified | Referral to Credit > 7.0x | Applications are reviewed on a case-by-case basis. |

Beyond the HEM: The Granular Scrutiny of Living Expenses

The era of relying solely on the Household Expenditure Measure (HEM) benchmark for living expenses is definitively over. HEM is now best understood as a floor or a minimum benchmark for expenses, not a substitute for a borrower’s actual financial habits. In practice, lenders will assess a client’s declared living expenses and compare them to the relevant HEM figure for their household profile. The serviceability calculation will then use the higher of these two figures.

Shading in the Margins: The Battle for Variable Income

While DTI caps and expense verification represent tightening measures, lenders are actively competing on the assessment of variable and non-standard income sources. The application of “shading”—or discounting—to these income streams can dramatically alter a client’s borrowing capacity.

A Case Study in Competition (AMP Bank): Non-major lenders are using more generous shading policies as a key point of differentiation. In a recent update, AMP Bank significantly relaxed its policies. It now accepts 80% of a client’s after-tax bonus income and simplified its rental income policy to a flat 20% shading for all residential properties.

A New Deal for the Self-Employed: Who’s Leading the Policy Shift?

The self-employed segment, comprising over two million Australians, has become a key target for lenders seeking to grow their loan books. This has triggered a wave of policy updates aimed at reducing the traditional friction and paperwork associated with these applications.

The Race to Simplify: ANZ and Westpac’s Aggressive Play

Westpac and ANZ have emerged as the most aggressive of the major banks in courting self-employed borrowers, overhauling their documentation requirements.

- Westpac: In July 2025, Westpac announced it would move to a one-year income assessment option for eligible self-employed applicants, halving the standard two-year paperwork requirement.

- ANZ: Following closely in August 2025, ANZ also reduced its income documentation requirement for director fees and company dividends to one year. Critically, they also removed the standard 3% interest rate buffer on fixed-rate asset finance, opting to use the actual repayment figure in serviceability calculations.

Location, Location, Limitation: Navigating Property & Postcode Scrutiny

Lender focus is increasingly shifting to the quality, type, and location of the security property itself. A strong applicant can still face refusal if the proposed security falls outside a lender’s tightening risk appetite.

The High-Density Dilemma: A Perfect Storm

There is a growing sense of caution among lenders regarding high-density, inner-city apartments. This is a rational response to a systemic crisis in the construction industry, where the construction of new multi-unit dwellings has plummeted. Consequently, many have implemented restrictions on high-density postcodes, often by reducing the maximum Loan-to-Value Ratio (LVR) they are willing to offer.

The Postcode Lottery: Understanding Location Risk

Nearly all lenders maintain internal lists of restricted postcodes, which are rarely made public but are communicated to brokers. A restriction may not be a judgement on the quality of the area but a reflection of a specific lender’s internal portfolio management. An application declined by one bank due to a postcode restriction may be perfectly acceptable to another with less exposure in that location.

The Refinance Battleground: Cashing In on Competition

The current environment of falling interest rates has created a highly active and competitive refinance market. Lenders are deploying aggressive tactics to capture market share, with cashback offers as their primary tactical weapon.

| Lender | Cashback Amount(s) | Minimum Loan Amount | Maximum LVR |

|---|---|---|---|

| ANZ | $2,000 | $250,000 | 80% |

| Greater Bank | $2,500 – $3,000 | $250,000 | 80% |

| IMB Bank | $2,000 – $4,000 | $250,000 | 80% |

| AMP | $2,000 | Not specified | Not specified |

Brokers must advise clients to look beyond the headline figure and weigh the upfront cash benefit against the interest rate, fees, and features of the loan over the long term.

The Broker Takeaway: Adapt, Advise, and Leverage

The era of standardized, “vanilla” lending is over. The current Australian mortgage market is a fragmented landscape of lender-specific niches. For brokers, thriving in this environment requires a fundamental evolution of their role and approach.

- Adapt: Success is no longer defined by simple product knowledge but by deep and constantly updated policy expertise.

- Advise: The broker’s role has irrevocably shifted from that of a loan processor to a strategic financial advisor, fulfilling the Best Interests Duty by matching a client’s full financial picture to the lender with the genuinely best policies for them.

- Leverage: The key to success lies in the intelligent use of available resources, including aggregator platforms and strong BDM relationships.

What policy change has had the biggest impact on your submissions recently?

Share Your Experience